german tax calculator for married couples

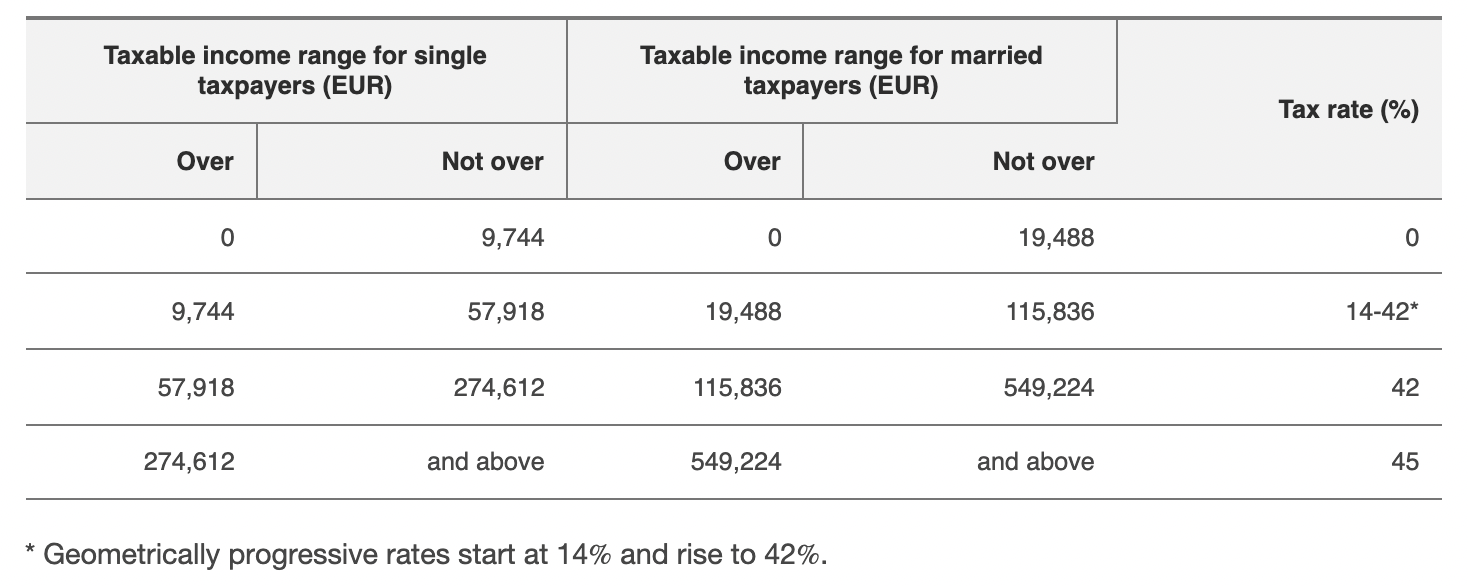

For singles the allowance based on information from 2021 is as high as 9744 while for married couples or people living in a recognized civil partnership the allowance is as. German Tax Class Calculator.

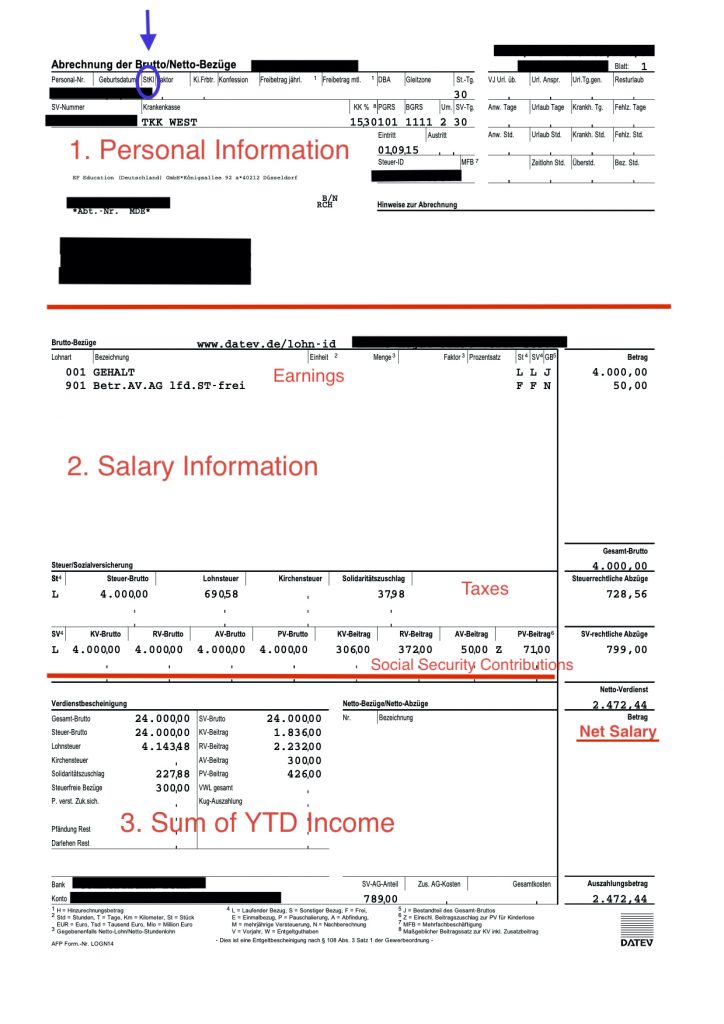

Cbp Form 7551 Fill Out Sign Online Dochub

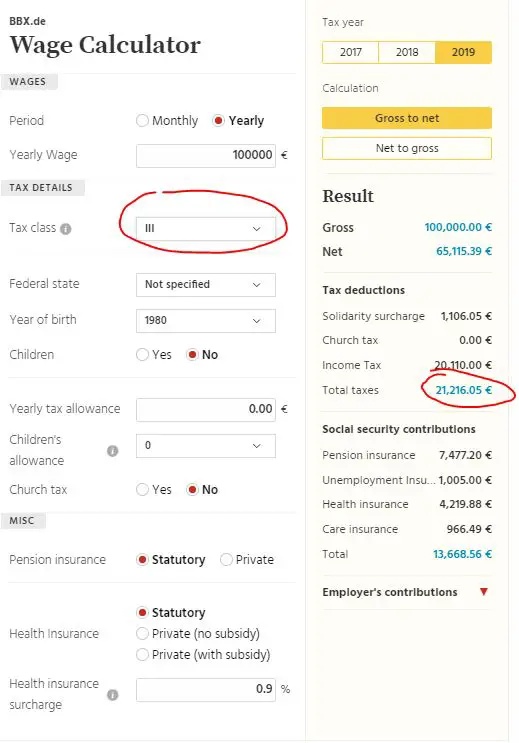

For a quick estimation of whether you should consider a tax class change to 3 and 5 you can use this German tax class calculator.

. Depending on your residency status see How is Income Tax Calculated in Germany you either owe taxes on worldwide. Marriage Tax Calculator Marriage has significant financial implications for the individuals involved including its impact on taxation. Geometrically progressive rates start at 14 and rise to 42.

If you are a Married or Jointly Assessed couple you could avail of significant German tax deductions. Note 1 on 2022 German Income Tax Tables. While the government receives part of the property inherited there are substantial tax-free allowances for close relatives.

Everyone who generates an income in Germany must pay taxes. First add your freelancer income and business expenses to the calculator. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

Owes annual German income tax of 2701. Overall tax for the couple when paying tax separately. The different Tax Categories of the German Wage Tax system.

This is a sample tax calculation for the year 2021. The calculator shows the inheritance tax. If married AND couple taxation.

The average refund for married German tax clients is 1950. Married couple with two dependent children under age 18 years. The German Wage Tax System is differentiating between 6 Tax Categories depending to the linving-circumstances of the.

Gross salary of one spouse of EUR 100000. The calculator below can help estimate the financial. This will generate your estimated amount for your Profit and Loss statement.

As you can see above the tax allowance is double for a married person. This will generate your estimated amount for. The average refund for married German tax clients is 1950.

This Wage Tax Calculator is best suited if you receive a salary. Married couples have the following options. Husband John earns 75000 EUR taxable income his wife Mary earns 0.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. If you are a Married or Jointly Assessed couple you could avail of significant German tax deductions. Married couple with two dependent children under age 18 years.

If not married Johns tax would be 42 x 75000 EUR - 878090 EUR 22719 EUR. It is very easy to use this German freelancer tax calculator. Joint couples tax using Steuerklasse 3 and 5.

Start tax class calculator for married couples.

How To Germany Paying Taxes In Germany

Joint Taxes In Germany 2022 Ehegattensplitting Explained

Tax Class In Germany Explained Easy 2022 English Guide

Germany S Tax Laws In A Nutshell Updated 30 May 2021 Berlin Tax Legal

Salary Calculator Germany This Is How Much Net Income You Will Earn Sib

I Want To Learn About German Tax Calculator And Also Is There Any Mandatory Tax Deduction Over And Above What Is Shown In The Calculator Quora

Income Tax In Germany For Expat Employees Expatica

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Why Households Need 300 000 To Live A Middle Class Lifestyle

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

German Income Tax Calculator All About Berlin

German Rental Income Tax How Much Property Tax Do I Have To Pay

How To Change Your Tax Class In Germany Jetztpat

Net Income For Couples R Germany